Credit card payoff calculator with extra payments

Please include your name and full account number on your check or money order and mail your payment to the address below. Paying off debt in fixed.

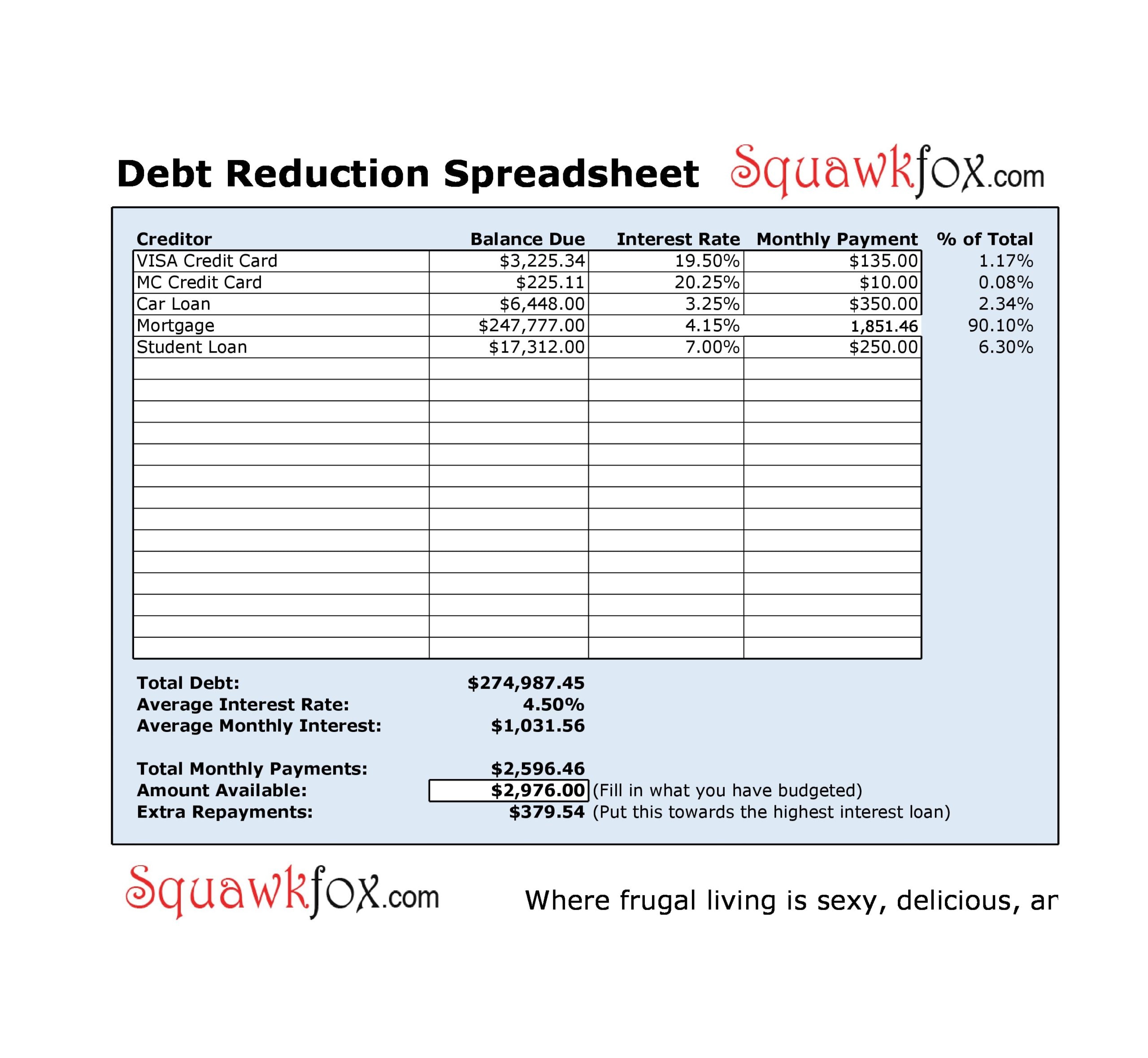

Free Credit Card Payoff Spreadsheet Get Out Of Debt In 2022

Please do not send cash.

. Therefore you will lose money to make biweekly payments and have a recurring balance on your credit card bill. How much faster your new payments will pay off the line of credit compared to. Guide published by Jose Abuyuan on January 13 2020.

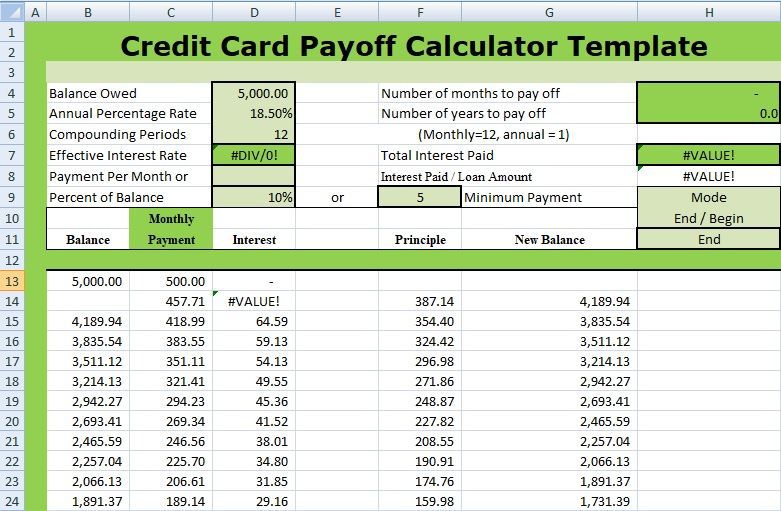

Credit Card Consolidation Calculator Recommended for. This calculator lets you also include one or two future purchases average monthly charges and an annual fee. Effective Ways to Pay Off Credit Card Debt Faster.

The loan calculator on this page is a simple interest loan calculator. Box 6294 Carol Stream IL 60197-6294. Time until your debt is paid off or the monthly payments required to payoff debt by a certain date.

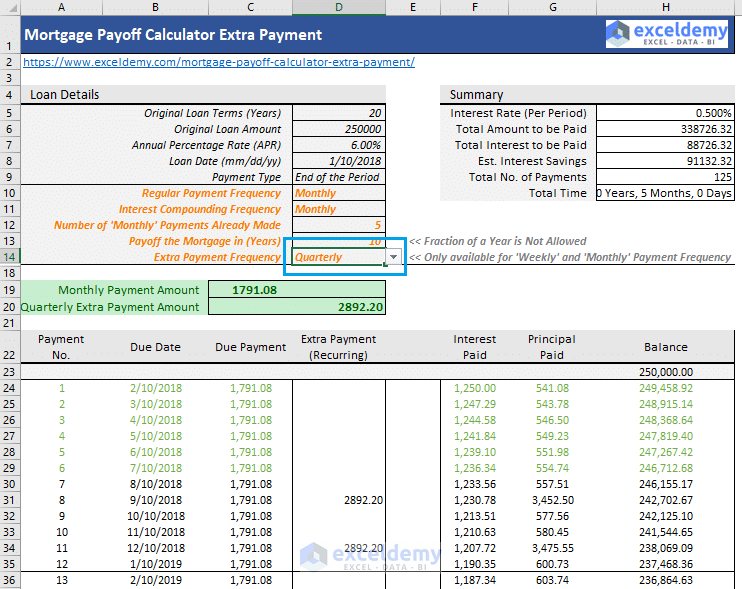

Since creating this spreadsheet Ive created many other calculators that let you include extra mortgage paymentsThe most advanced and flexible one is my Home Mortgage Calculator. When you make a payment your loan balance doesnt always decrease by the amount you pay. This credit card payoff calculator is intended solely for general.

Furthermore anyone who is considering applying for a home mortgage should wait until they have closed on their loan before applying for a new credit card. But the higher your credit score the more favorable. Calculate how long it will take to pay off your credit card balance.

In order to calculator your payoff date youll need to figure out how much your balance is each day by adding transactions plus interest add up all your daily balances to get your monthly balance subtract the payments you will be making then calculate your new daily balances for each day until your bill becomes 0 then count how many days that took. For overnight mail send your payment to. Estimating savings by making one-time extra payments.

Some lenders may charge extra fees for bi-weekly payments or switching fees if you are already on a monthly mortgage payment schedule. The monthly payments need to pay off your line of credit in a certain amount of time. A loan calculator is an automated tool that helps you understand what monthly loan payments and the total cost of a loan might look like.

The effect that an increase or decrease in the adjustable rate will have on paying off the line of credit. Extra payments count even after 5 or 7 years into the loan term. Field Help Input Fields.

The Federal Reserve Bank states that the total credit card debt reached 1088 in October 2019. In order to pay off 10000 in credit card debt within 36 months you need to pay 362 per month assuming an APR of 18. Then see how much sooner you can be out of debt by making extra.

Calculate the difference in total interest paid on a mortgage loan when making additional monthly payments. You keep up with the minimum payments on all your cards and make extra payments on the card with the lowest balance. Our debt payoff calculator shows you either.

While new credit card applications do not have a major impact on credit scores mortgage lenders do not like to see applicants requesting new lines of credit before they close on their loan. Estimating savings from consolidating with a personal loan. However just making extra payments with money that you get from bonuses or tax returns is better than just paying on the loan.

You can find various types of loan calculators online including ones for mortgages or other specific types of debt. If you own real estate and are considering making extra mortgage payments the early mortgage payoff calculator below could be helpful in determining how much youll need to pay and when to meet a certain financial goal. The Debt Payoff Calculator above can accommodate a one-time extra payment or multiple periodic extra payments either separately or combined.

How long it would take to pay off your loan making your current payments. Chase Card Services 201 N. One day Christine had lunch with a friend who works as a.

Where can I mail my credit card payment. Use these credit card repayment calculators to work out effective strategies to pay off your credit card debt. Before deciding to pay off a debt early borrowers should find out if the loan requires an early payoff penalty and evaluate whether paying off that debt faster is a wise decision financially.

More Debt and Loan Calculators. The key is to make extra payments consistently so you can pay off your loan more quickly. She decided to supplement her mortgage with extra payments to speed up the payoff.

This credit card payoff calculator shows you when youll be debt-freePut in your debts interest rates and monthly payments. Early Mortgage Payoff Calculator. This debt payoff calculator figures how much you need to pay each month so that your are.

Walnut Street De1. While you would incur 3039 in interest charges during that time you could avoid much of this extra cost and pay off your debt faster by using a 0 APR balance transfer credit card. At the very least you should have a 620 credit score to obtain a conventional loan.

Many credit card issuers allow cardholders to carry a balance month-to-month and make minimum payments usually around 25 or 3 of the total balance partly for the cardholders convenience but also because it benefits the issuer to create a big interest charge. If the first few years have passed its still better to keep making extra payments. By focusing on.

Thats an increase of 88 percent from. Put simply its a standard mortgage calculator with extra payments built-in so its really easy to use. The Mortgage Payoff Calculator above helps evaluate the different mortgage payoff options including making one-time or periodic extra payments biweekly repayments or paying off the mortgage in full.

The Early Loan Payoff Calculator is another loan payoff calculator that will help you figure out how much extra to pay each month to pay down the loan by a desired years or months. For Excel 2003. SmartAssets credit card calculator allows you to add your credit card debt details to calculate the total interest and time it will take for you to pay off your debt.

Alternatively use the second calculator to work out how much you should pay each month to eliminate your credit card balance completely in a set period of time. Your balance probably wont go down by 100 if you make a 100 paymentunless you have a 0 interest loan and no other fees or charges. Things to Watch Out For Bi-Weekly Payments.

Use our student loan calculator to estimate monthly student loan payments payoff term length interest rates best repayment options and more. The CUMIPMT function requires the. If you have credit card debt youre one of thousands of Americans struggling to clear their balance.

A title for these calculator results that will help you identify it if you have printed out several versions of the calculator. If you want to pay off your credit card you will need to make more than the minimum payment each month to reach your goal. A simple credit card payoff calculator similar to the spreadsheet above.

Loan Payoff Calculator Know Your Debt Free Date Credello

Debt Payoff Calculator Spreadsheet Debt Snowball Excel Etsy

30 Credit Card Payoff Spreadsheets Excel Templatearchive

Mortgage Payoff Calculator With Extra Payment Free Excel Template

Pin On Useful Templates

Free Credit Card Payoff Spreadsheet Get Out Of Debt In 2022

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Loan Payoff Calculator Paying Off Debt Mls Mortgage Loan Payoff Credit Card Consolidation Credit Card Payoff Plan

Mortgage Payoff Calculator With Line Of Credit

Debt Payoff Calculator Spreadsheet Debt Snowball Excel Etsy

Credit Card Debt Payoff Spreadsheet Excel Templates

Credit Card Payoff Calculator Compare Options Nerdwallet

Extra Payment Mortgage Calculator For Excel

Credit Card Balance Transfer Calculator For Excel

Mortgage Payoff Calculator With Extra Payment Free Excel Template

Credit Card Payoff Calculator Compare Options Nerdwallet

Biweekly Mortgage Calculator With Extra Payments Free Excel Template